Can Trucking Telematics Help Reduce Insurance Rates?

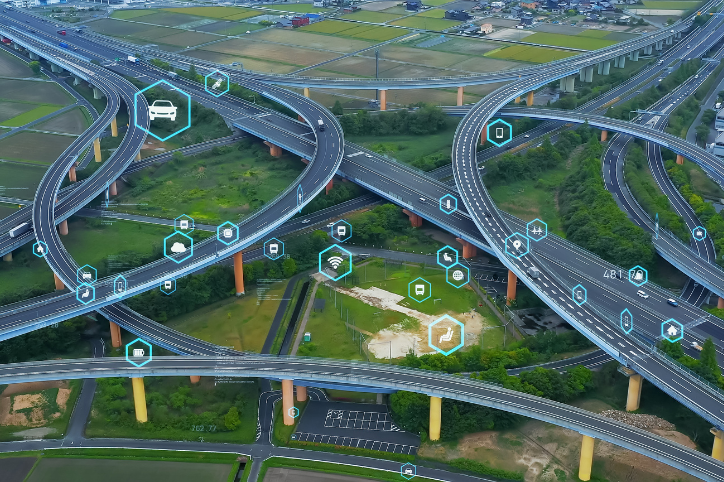

Trucking telematic devices are being widely used in commercial trucking to track drivers’ behavior, routes, and vehicle usage. The data collected by the devices allows fleet operators to better manage their risk exposure. But can trucking telematics help reduce insurance rates?

The real-time data that telematic devices gather and analyze provides information that trucking operations can use to assess risks and proactively make changes to eliminate unsafe behaviors. The data collected is also being used by insurance companies to determine the risk exposure of certain accounts more accurately.

So – are trucking telematics actually reducing insurance rates?

According to the trucking industry news source Freight Waves, commercial fleet operators that can consistently demonstrate their drivers practice safe driving habits, such as adhering to speed limits, braking smoothly and accelerating sensibly, are likely to experience lower insurance premiums. In addition, vehicle tracking provided by devices can aid in theft recovery and claims processing, as well as help fleet owners determine safer driving routes and ensure the proper maintenance of vehicles — all of which can further reduce insurance premiums.

Lower insurance costs provided by trucking telematics can benefit all types of drivers. However, Freight Waves notes that this technology can be especially useful for:

- New or inexperienced drivers. Information from devices can help newer drivers improve their driving skills, which in turn can help lower their cost of insurance.

- High-risk drivers. Telematic data collected from drivers who have a history of driving violations, such as excessive speeding or accidents, can show they have improved overall driving behavior – something an insurance carrier will take into consideration come renewal time.

Fact: An estimated 61% of fleets use trucking telematics to control and optimize vehicle speed. - Mileage-counting drivers. The ability of trucking telematics to track and verify the exact number of miles driven can help lower insurance premiums.

Fact: An estimated 66% of fleets use trucking telematics to track hours of service. - Eco-friendly drivers. Drivers who can prove they drive as efficiently and as sustainably as possible are also likely to enjoy lower insurance rates.

Fact: Telematics reduces vehicle travel time to sites by 68%, reducing carbon dioxide emissions by 75%.

Trucking telematics can also give fleet managers greater visibility into where their vehicles are being driven, the routes taken and the speed of the vehicles — all in real time. In the event an issue develops, immediate measures can be taken to improve driver safety and efficiency, which can ultimately result in a cost savings. An estimated 74% of fleets use trucking telematics to monitor vehicle and equipment locations.

If you’re not using telematics to monitor risky driving behaviors and following up with driver coaching, expect to pay more for insurance, especially now that such platforms are more affordable to fleets of all sizes.

Source: Truck News

To learn about our transportation insurance products and how we can best serve you, our retail broker clients, please email marketing@acrossamericainsurance.com or call 760-302-5300.

Need to get appointed with Across America? You’re so close! Get set up to do business with us.